Network component and equipment market research firm Cignal AI has released its latest Transport Hardware Report.

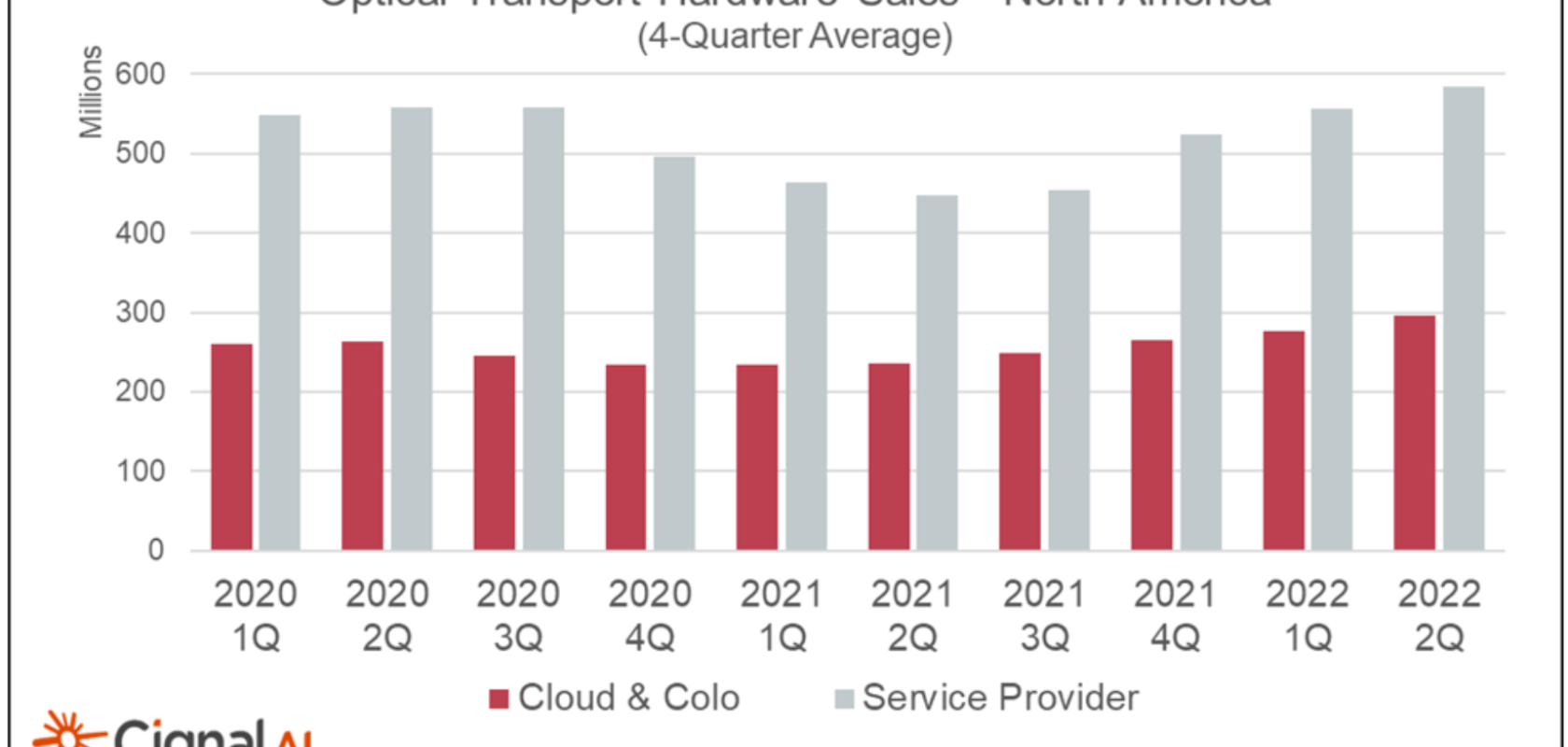

The report found that spending on optical transport hardware by North American network operators grew more than 20 per cent in 2Q22 compared with 2021. This means that equipment capex by traditional network operators as well as large cloud operators has now surpassed pre-Covid levels. However, spending by European and Asian operators remains low by comparison.

Bookings remain exceptionally strong, said the report, with large vendors universally reporting orders exceeding revenue resulting in record backlogs. The company says that equipment vendors indicated supply chain difficulties affected their ability to ship products and delayed network deployment and acceptance, postponing recognition of some revenue.

Amongst the report’s other findings, worldwide cloud and data centre colocation (colo) spending grew more than 10 per cent, compared to roughly flat spending by traditional service providers. Meanwhile, enterprise and government sales declined year-on-year for the fifth consecutive quarter as the heightened spending levels during the pandemic reverted to normal. Cignal AI cited that Cisco, Infinera, and Adva benefited the most from an increase in spending by cloud operators in North America.

Some of the results also varied widely by region. For example, the report demonstrates that North American optical revenue grew to the highest second-quarter level on record, while European spending declined. EMEA’s decline is put down to a shift from transport to RAN spending, combined with a disadvantageous dollar exchange rate.

Worldwide packet transport sales grew 6 per cent, driven by cloud and colo packet spending, which grew 16 per cent. North American packet transport sales also climbed in tandem with optical and grew more than 30 per cent, with Cisco, Nokia, and Juniper all participating. EMEA packet sales fell.

Kyle Hollasch, lead analyst for transport hardware at Cignal AI said: ‘Funding for broadband infrastructure, continuing 5G rollouts, and pent-up demand because of supply chain disruptions have catalysed growth in North American transport spending. Massive order backlogs and an anticipated easing of supply issues point to a period of rapid spending growth for Service Providers and Cloud operators in the region.’