According to optical analyst firm LightCounting’s updated Market for Optics in China report, China has had a greater impact on the global optical communications industry than any other country over the last decade - in some cases more than all other countries combined – and this is likely to continue between now and 2023.

Last year, however, saw the rise of this market raise a few ‘red flags’ with the US government entering into a trade war, with the temporary ban on ZTE, and the ongoing dispute with Huawei, for example, said LightCounting, looking like part of a larger US government agenda to curb the influence of China on the global economy. The problem, stated the report, is the interconnection in the world’s economy, meaning that trade barriers imposed by one country are likely to hurt consumer confidence and businesses across many.

At the time of publication, Apple and Invidia are amongst some of the larger US-based companies reporting drops in quarterly revenues because of slower demand in China. Alibaba put a delay on hiring and restricted travel expenses in anticipation of slower growth. Huawei, meanwhile, saw its networking businesses slow in 2017-2018, although it did set new records in smartphones. The company’s founder has been quoted as saying that the trade war has not impacted its 2018 business, but can’t rule out any future difficulties or challenges.

The report also cites work at home as keeping Chinese suppliers busy this year, with domestic infrastructure projects, and the acceleration of 5G wireless infrastructure – it granted licenses to the three largest CSPs in December 2018. China Mobile plans to start commercial deployments in the second half of 2019 and China Telecom and China Unicom in early 2020. Domestic deployment will generate large contracts to the Chinese equipment suppliers to offset slower business abroad, and additionally boost demand for higher speed optical transceivers, such as wireless fronthaul, Ethernet and DWDM modules.

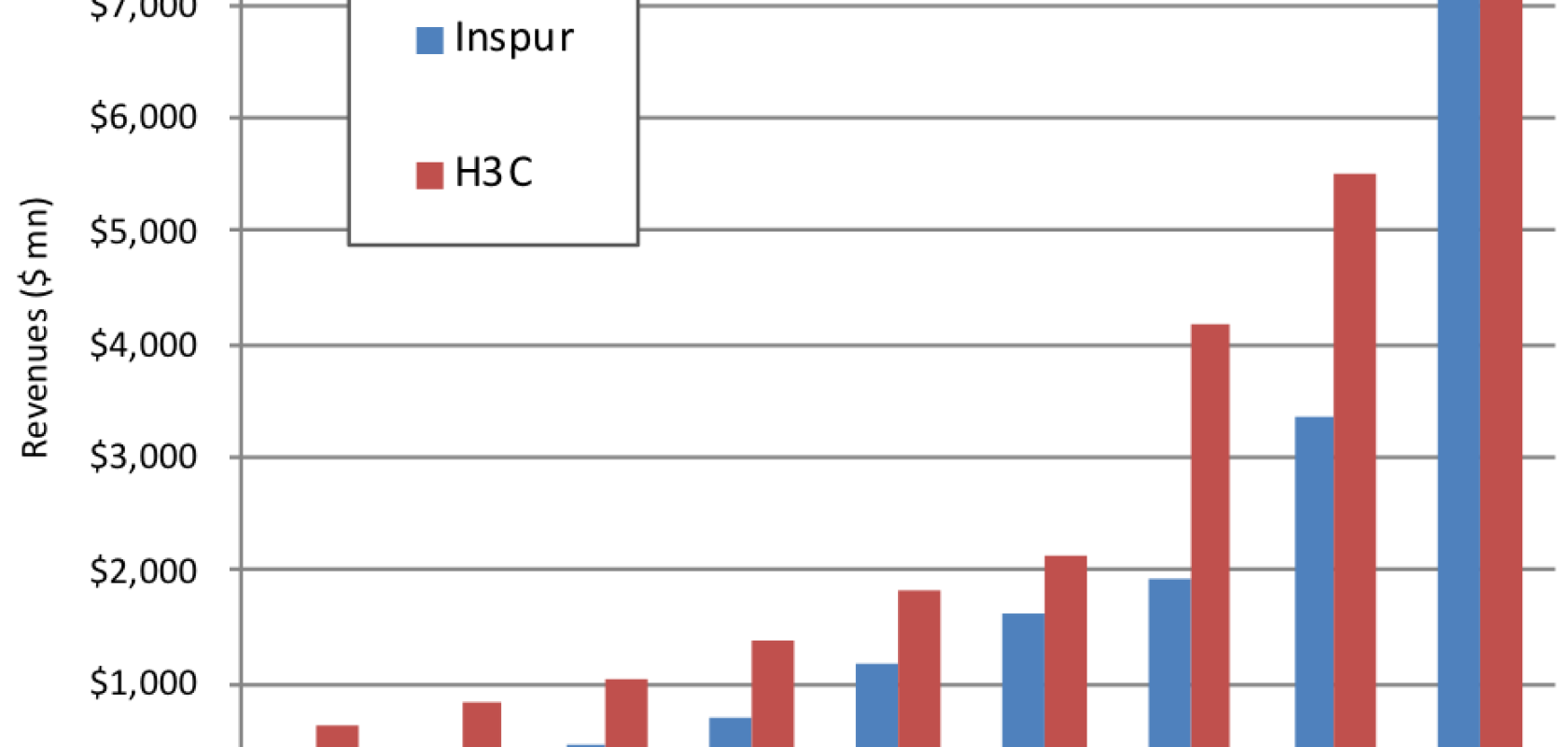

According to LightCounting, the continuation of upgrades of Cloud data centres in the region to 100GbE connectivity, along with future deployments of 400GbE, will most greatly impact on sales of networking equipment, optical components and modules deployed over the next five years. Looking at sales of data centre equipment for deployments in China, Inspur and H3C ramped revenues by 50-100 per cent in 2018 (see Figure 1: Annual revenues of H3C and InspurSource: Company Financial Reports and LightCounting Estimates). These companies, as well as Huawei, Lenovo and ZTE, are selling their products, but also building complete data centres and managing their operations. Local governments fund many of these projects, often in partnerships with Chinese cloud companies and equipment suppliers.

Initial data on performance of large state-owned companies in China is very impressive, with 10 per cent growth in revenues and 15 per cent growth in profits for 2018. Looking at whether this can continue, however, and smaller private enterprises should be taken into account. These are currently struggling and pointing towards tightening credit. The Shanghai Stock Exchange Composite Index contracted by 30 per cent last year, and stock prices of Chinese Internet companies actually fell more dramatically than the those of US technology stocks.

Historically, said LightCounting, the Chinese government has acted decisively during economic slowdowns, and in this instance is already increasing infrastructure spend for 2019, including many new subway lines. 5G wireless systems and Cloud data centres are part of the increased infrastructure spending as well, supporting our projection for the market for optics in China next year.