The data centre market is a particularly wide-ranging one, with one of the driving forces in recent years the emergence of the hyperscale data centre or cloud service provider.

Despite the pandemic causing chaos in most sectors, much industry intelligence about data centres points to ongoing growth. The Data centre construction – global market trajectory and analytics report from Research and Markets, for example, highlights that, amid the crisis, the global data centre construction market was estimated at $19.4bn last year. This is now projected to reach a revised $31bn by 2027, growing at a compound annual growth rate (CAGR) of 6.9 per cent over the analysis period.

Gartner focuses on data centre infrastructure spend in its report, General manager insight: data centre infrastructure spending downturn and three actions for recovery. Market intelligence first stated that, despite a 10 per cent spending decline in 2020, the data centre market will rebound over the next four years.

Growing pains

End-user spending on global data centre infrastructure, the report states, is projected to reach $200bn this year, an increase of 6 per cent from last year.

Naveen Mishra, senior research director at Gartner, explained: ‘The priority for most companies in 2020 was keeping the lights on, so data centre growth is generally being pushed back until the market enters the recovery period. Gartner expects larger enterprise data centre sites to hit pause temporarily, then resume expansion plans early this year.’

There is, of course, one exception to those ‘hitting pause’, as one might imagine. Mishra elaborated: ‘Hyperscalers will continue with their global expansion plans due to continued investments in public cloud.’

While pandemic lockdowns prevented a high percentage of facility construction in 2020, end-user spending is expected to grow in single digits starting in this year. Mishra continued: ‘Much of the reduced demand in 2020 is expected to return in 2021, when staff can physically be onsite. For now, all data centre infrastructure segments will be subject to cost containment measures, and enterprise buyers are expected to extend life cycles of installed equipment.’

Cost optimisation

Data centre infrastructure general managers should seek to prioritise a select set of existing and new customers, said Mishra. Specifically, Gartner recommends training the sales force to engage with the chief financial officer and chief procurement officer on a set of cost optimisation initiatives, such as renegotiating IT contracts, optimising cloud costs and consolidating IT.

Another recommendation is to create an industry playbook that helps technology providers understand Covid-19’s impact on a range of different industries to then recommend short- to mid-term action items for the given providers by each industry.

Finally, recommends Mishra, it would be worth investing in a new go-to-market model for digital natives to drive innovation. ‘Build momentum around hybrid IT and consumption-based pricing,’ he said, ‘to improve mind share with digital natives.’

In terms of the market’s impact on component vendors, the issue of cost optimisation is not necessarily something that has only come about due to the pandemic. As a manufacturer of 3D glass-based integrated optical components for the data centre, Optoscribe has seen a number of trends in this area since its inception more than a decade ago.

CTO Nick Psaila explained: ‘We make glass components that go inside data centres, such as transceiver modules and some of the components of the fibre infrastructures of the data centres – basically glass chips that go into these and the interface between the fibres and the active parts of the transceiver.

’For our data centre customers we have been helping to try and drive down the overall costs of the modules by facilitating easier methods of assembly and packaging.’

Performance vs cost

While the data centre market is expected to remain buoyant, the driving forces are, in many cases, also the challenges when it comes to components. Psaila said: ‘One of the biggest pressures on the industry, as a whole, is to simultaneously increase the speed and bandwidth of these transceivers, while dropping the price per-gigabit per-second.’

Another trend within data centres impacting on component suppliers is the fibre itself, specifically, the debate between multimode and single mode fibres. ‘Previously, the data centre had been dominated by multimode,’ said Psaila.

‘That’s another trend that substantially moved forward, and that’s been fueled by the hyperscalers specifically. They’ve taken these architectural decisions. This compares to the challenge we were talking about earlier, in terms of trying to drive down the cost of these transceivers, because we have to do that with single mode transceivers, which are even more complicated to build.’

This performance-cost balance has been a key driver when it comes to product development, with new technologies that can help to address the challenge of building these transceivers in a more cost-efficient way.

Said Psaila: ‘The big hyperscale data centre users have a lot of buying power, which can put pressure on the components manufacturers to drive all of their margins out. In some cases, there will be technologies that inevitably cannot cost-reduce beyond a certain point.

‘This will drive solutions that enable those lower costs per-gigabit per-second, but also, technologies which can scale in terms of density. So the number of channels is also going up for these transceivers, and also the depth and speeds of each channel.’

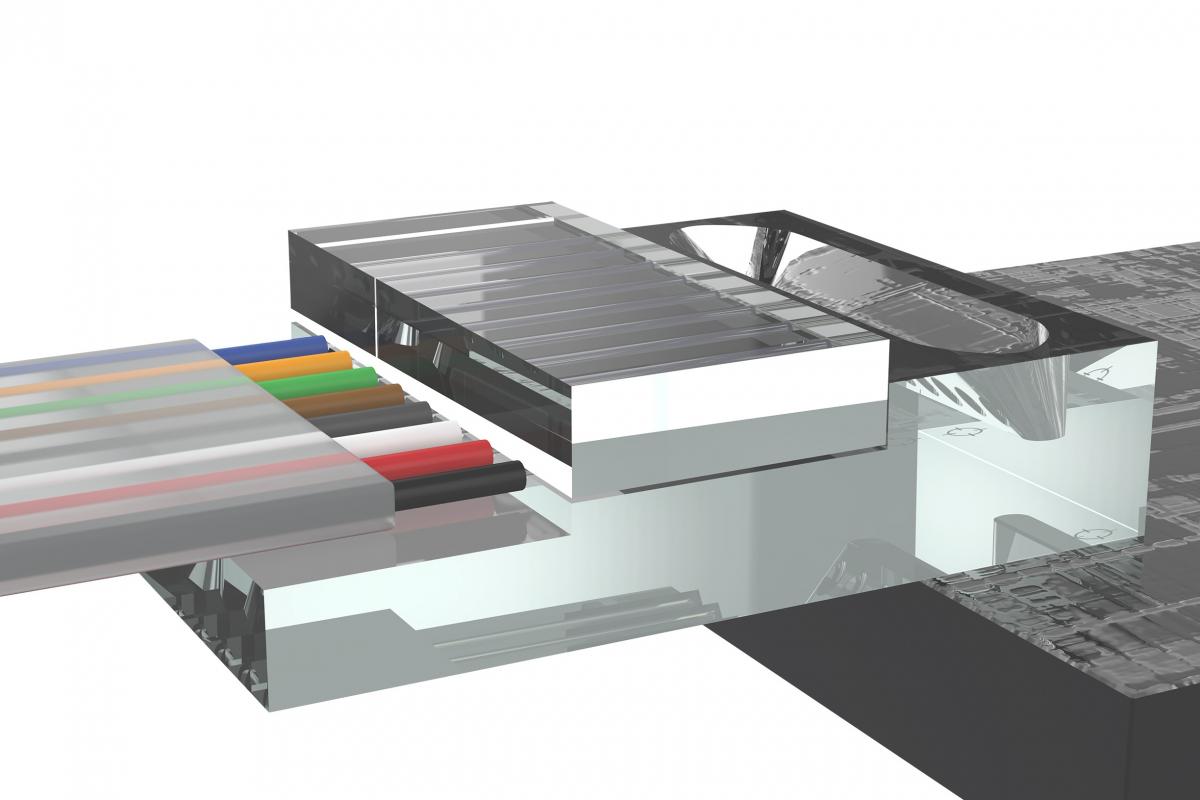

Optoscribe’s own product development in this area recently produced a monolithic glass chip for low-loss coupling to silicon photonics (SiPh) grating couplers. The chip is designed to overcome fibre-to-SiPh photonic integrated circuit (PIC) coupling challenges to enable high volume automated assembly and help drive down costs.

It was created using the company’s high-speed laser writing technique and features low-loss light turning curved mirrors, which are formed in the glass, to direct the light to or from SiPh grating couplers. This prevents the need for bend-tolerant fibre solutions.

To help address footprint challenges, the chip also has a low-profile interface of less than 1.5mm in height. This allows compact interface layouts that alleviate packaging constraints. It is compatible with industry-standard materials and processes, helping to maximise performance. ‘We launched the OptoCplrLT chip in December,’ said Psaila, ‘and we’re continuing to work on a range of additional products that we look to launch over the coming year in this application space. The technology has a lot of advantages, particularly in the form factor and also in facilitating passive alignment, for example, to try and drive down the cost of these assemblies.’