Will silicon photonics live up to its promises? Pauline Rigby investigates

For the past several decades, silicon photonics has promised to disrupt the optical components industry by providing a common platform on which diverse optical functions can be integrated in a way that scales easily to high volumes, while keeping manufacturing costs low. That platform is complementary metal-oxide semiconductor (CMOS) – the bedrock process of the semiconductor manufacturing industry – which also opens up the possibility of integrating electronics and optics on the same substrate. It’s no wonder the industry speaks of the potential for disruption.

But innovation can be a bumpy road, as highlighted by Mellanox’s recent decision to discontinue development of its 1550nm silicon photonics technology and products. Emerging technologies must survive the ‘hype cycle’ – moving through a phase of overzealous industry expectations and the subsequent ‘chasm of doom’ as flaws and failures in processes and products lead to disappointment, before the technology (hopefully) matures. In Mellanox’s case, the story has ended prematurely.

Diane Bryant, former executive vice president and general manager of Intel’s Data Center Group, launches the company’s silicon photonics product line at the 2016 Intel Developer Forum

For silicon photonics, the hype cycle probably reached its peak in 2012, when Cisco splashed $270 million on technology start-up Lightwire. ‘Forecasting technological disruptions is probably just as hard as predicting earthquakes,’ as Vladimir Kozlov, founder and principal analyst with market research firm LightCounting, admits. ‘Being prepared seems to be the only practical solution,’ he observes. ‘Even a distant possibility of a disruption justified $270 million investment into silicon photonics technology made by Cisco in 2012.’

Mellanox’s acquisition of Kotura, a deal valued at $82 million the following year, was ‘partially a defensive move’, according to Kozlov. ‘It was part of their strategy of ultimately competing with Cisco in the data centre switching market … If your competitor acquires this technology, you can’t afford not to have it, in case it becomes really successful,’ he suggests. Kotura had developed a line of variable optical attenuators (VOA) in silicon photonics and had a roadmap that would help Mellanox drive down the cost of high-speed optical interconnects.

Regrettably, the Kotura team could not demonstrate that silicon photonics could fulfil that potential. In December 2017, Mellanox president and CEO Eyal Waldman reported that the company ‘began our review of the silicon photonics business in May of 2017, but as the business did not become accretive as we had hoped, we decided to discontinue our 1550nm silicon photonics development activities,’ adding that, ‘we appreciate all of the efforts of the silicon photonics team over the years and wish them success in their future endeavours.’

![]()

The burden of developing an emerging technology like silicon photonics will weigh more heavily on a company like Mellanox than it does on the goliaths like Cisco, IBM, and Intel. The near-term pressures of the stock market appear to have added to that burden; as investor pressure pushed Mellanox to cut projects that did not immediately contribute to the bottom line. ‘Unfortunately, it’s becoming the norm in the US, that companies have to trim their operations to satisfy Wall Street appetites for earnings for the next quarter, at the expense of longer-term projects that would be good for the company,’ commented Kozlov.

Mellanox’s story also reminds us that, while silicon photonics should drive lower costs in principle, this hasn’t yet been proven in practice. The two main players shipping silicon photonics products today – Intel and Luxtera – don’t share this kind of information. Luxtera is a private company, while Intel is a huge, profitable company where optics are a minor part of its operations and ‘if Intel were losing money on silicon photonics we just wouldn’t know,’ as one analyst observed.

Nevertheless, industry analysts say that Mellanox’s decision is no reflection on the technology as a whole; on the contrary, sales of silicon-photonics-based products are starting to rise and will steadily gain market share over the coming years. Oregon, US-based market research firm LightCounting last year forecast that shipments of silicon photonics transceivers will exceed $2 billion by 2022, accounting for more than 20 per cent of the global optical transceiver market. Meanwhile market research firm Yole Développement, based in Lyon, France, predicted in January that silicon photonics will have a 2025 market value of $560 million at chip level and almost $4 billion at transceiver level.

What’s interesting is that the contribution of silicon photonics to the optical transceiver market, in terms of number of units shipped, is expected to remain below 2.5 per cent of the total even by 2022, according to LightCounting. That’s because most products will be high-end devices, operating at 100G data rates or above, and priced accordingly.

Though silicon photonics originally promised to enable high-volume, low-cost designs, it is making its mark in applications where existing technologies fail to deliver, such as the more complex designs required for high-speed modules.

Silicon photonics will be vital for the even-more-complex 400G data centre transceiver designs, according to Roy Rubenstein, editor of Gazettabyte and author of a book with Daryl Inniss entitled Silicon Photonics: Fueling the Next Information Revolution. ‘2017 was a quiet year for silicon photonics technology but that is because we are currently between [product] generations – after 100G but before 400G,’ he commented. He believes that the merits of the technology will become more compelling with time, as development efforts start to bear fruit.

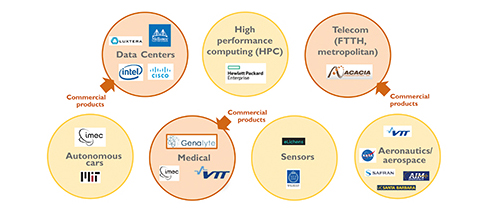

Silicon photonics applications range

Likewise, Eric Mounier, senior technology and market analyst at Yole, believes the worldwide development effort must yield results eventually. ‘We believe we are only at the very beginning, as there is massive ongoing development worldwide for further integration,’ he claims. The recent involvement of large chip foundries, such as TSMC’s relationship with Luxtera, and GlobalFoundries with Ayar Labs, is very encouraging, he says. Semiconductor foundries and their partners are now developing ‘zero change’ processes – where optical components can be manufactured on semiconductor production lines without making any changes to the CMOS process. Having such processes available will allow photonics to be added to even the most advanced CMOS process nodes.

Two things about silicon photonics are now clear: one, the technology has passed the ‘tipping point’ as products are shipping in volume and successfully competing with established technologies; and two, despite the above, there are still plenty of challenges to be overcome. ‘Silicon photonics is at the maturity level of the electronics industry in the 1980s and there are still challenges to overcome,’ Mounier claims. These include the need for laser integration (as silicon does not emit light), advances in packaging and wafer level testing, and better photonics design and process development software.

Contrary to expectations for an abrupt market dislocation, it appears that silicon photonics is set to play an increasingly important role in the optical components market. All established component and module suppliers have silicon photonics technology on their roadmaps, and this is backed by a growing interest from the semiconductor foundries. ‘The chances for success of these efforts are real and no vendor can afford to ignore the possibility of a disruption,’ LightCounting’s Kozlov concludes.